eSaver Account

Apply now

Our new eSaver account offers you attractive interest rates and gives you the flexibility to access your funds anytime putting you in control of your savings!

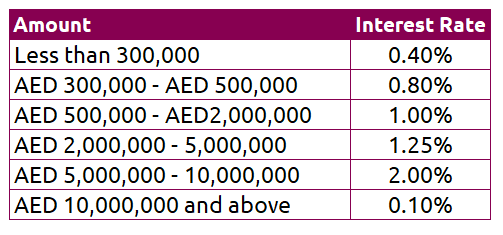

Interest rates from 13th April 2026 onwards.

Interest rates from 15th December 2025 until 12th April 2026.

* Interest rates are calculated daily based on the end of day account balance.

View applicable fees and charges.

Already a CBI customer? Follow these simple steps now:

- Login to CBI Internet Banking

- Open your eSaver account using "Apply for Product"

- Make a deposit into your new account

Not a CBI customer yet?

- Just click 'Apply now' button and fill the online form so we can get in touch with you shortly

Supporting documents for New CBI Customers:

- Your original passport (with at least 1 month left before expiry)

- A valid Visa for expatriates

- Valid Emirates ID

- Proof of address (such as bank statement, utility bill, letter of employment, tenancy agreement)

- For non-residents: a reference letter from your current bank

- No Minimum Balance Required

Terms & Conditions:

- Existing customers can avail this rate on receipt of new funds only.

- eSaver account can only be opened using our Internet Banking.

- Limited withdrawals (One withdrawal per month). *

- Limited time offers.

- Other T&C’s may apply.

*Note:

The Customer agrees that at the sole discretion of the Bank, the interest rate and its application on an account may change at any time without prior notice to the Customer. The Customer agrees to refer to the Bank's official website for the applicable interest rate and charges (which may be amended at any time).

The Customer agrees that in relation to the Saving Accounts, he/she shall not be entitled to any interest applicable on the available funds in the Saving Accounts in case there is more than one withdrawal in the account in one calendar month. All withdrawals from the savings account shall be considered for interest forfeiture except fees and charges

- Warning: The Bank reserves the right to immediately block or close the Account(s), without prior notice, if it has reasonable grounds to believe there is a financial crime or fraud risk.

- Warning: If updated KYC documents and valid identification are not provided within 90 days, your ATM card will be blocked. Transactions may still be conducted through the branch.

- Warning: You must provide the Bank with up-to-date documents at all times. Failure to do so may result in charges, transaction restrictions, account blockage, or account closure.

- Warning: Certain products require a minimum balance to be maintained in order to earn interest.

- Warning: In accordance with UAE Central Bank instructions, your account will be closed and blacklisted if four cheques are returned due to insufficient funds within a one-year period.

- Warning: Failure to comply with the Bank’s terms and conditions, before or during the banking relationship, may result in restrictions, blockage, or closure of your account.

- Warning: The Bank may apply any credit balance held in your name, in any account or branch, toward any amount you owe to the Bank.

- Warning: You may make one withdrawal per month on your eSaver account. Any additional withdrawals will affect the interest accrued on your account balance.

Ways to Bank

eSaver FAQ's

eSaver Account

CBI | Personal banking